Seat belts fastened? Seat backs and tray tables up and locked?

Futures down hard before breakfast. The market’s daily reminder that confidence is a perishable good. A kind of “just ahead of Valentine’s” massacre in finance is swirling.

Fair warning: this is one of those mornings where the market opens first — and then something older and deeper insists on being said, so consider this two columns sharing the same page.

The Usual Suspects: Trump, Iran, Greed

First, the Fed chair rumor mill is back on full blast. Anytime traders smell a change in who’s holding the rate lever, they immediately assume “less friendly than my fantasy spreadsheet.” Futures hate uncertainty more than bad news, so they sell first and ask questions later.

For us, this looked like another Elliott (small) three down. I plan to exit a short position at the open before the Trump “new hire” is popped.

Second, Big Tech finally tripped over its own cape. AI spending keeps exploding, but profits aren’t keeping pace, and the market is doing that classic move where it suddenly pretends margins matter again. When the generals wobble, the whole army retreats.

Third, global tone is soggy. Asia didn’t inspire, Europe didn’t rescue, and overnight markets sent the unmistakable signal: “maybe risk isn’t free anymore.” That’s all it takes for leveraged money to hit the eject button.

Fourth, positioning. Everyone was leaning the same way, feeling clever, telling themselves this dip-buying thing is eternal. When futures slip through a few technical trapdoors, stops fire, algos pile on, and suddenly it looks like “news” caused it. It didn’t. Crowding did.

Translation for UrbanSurv readers: nothing broke overnight — well, except sentiment did. This is the market reminding people that gravity still exists, even in an age of infinite narratives and infinite liquidity.

By the open, we’ll hear ten different stories explaining the same thing: too many people got comfortable, and the market reached for the cattle prod. Virtually all will ignore the Big Complicated Math only a few people can wrap their perceptions around. Most folks are too domain-locked to “get over themselves.”

Mental Models Matter

You know what a “dream board” is right? Try this one on as a “thinking template” which you can adjust and restructure to the way you see things forward from here.

Not sure what a “dream board” is?

In the realm of UrbanSurvival, envision this Grand Canyon cartoon as a mental “dream board”—a vivid topology of the future, where February crowns the rim as our starting point and May anchors the depths as an uncertain endpoint.

Layered like sedimentary strata, the canyon walls—etched with looming events from China’s economic maneuvers, Iran’s geopolitical tensions, Europe’s regulatory shifts, Ukraine’s ongoing conflicts, and Minnesota’s domestic ripples—reveal a stratified map of risks, allowing preppers to trace widening chasms in global stability or narrowing bridges toward resolution, fostering proactive navigation through tomorrow’s turbulent terrain.

Write this down because it is “where magic” has been hiding in plain sight. The Future is a shape-shifter.”

Every time a news event registers in the Global Mass Consciousness, it morphs and modifies one of the canyon walls – this way, or that. That’s how (in modeling terms) the future SURFACES.

It’s also how prayer works, too. But we will get deep, deeper, deepest in the Around the Ranch section in a minute. For now, “the news” is like small “probability bonfires” that illuminate (or extinguish) one probable future from another. It’s really quite elegant – how it all works – little influencers (individually, like prayer) are fleeting fireflies just a flicker – welding sparks.

Occasionally, a pseudo-random spark will land. When it does, a bonfire may be lit – a path into Future changes.

Ah, but knowing a few Old Time Monks, you probably already got this far. But often we forget – which is why – in the midst of pending financial chaos and a potentially pivotal month – we can calmly take it all in. Then test-fit (headlines are all you need when your baseline situational-awareness is on fire – so see how “clouds of probability cluster, morph, and then surface over time..

The Morphology of Morning

Knowing, as we do, here’s how the shimmering chess pieces of future are marching from the past – through today – and onto a future. Which is at once predictable, but never certain. Think of these as the “Biggest Bonfires” for the public. But people – individuals – have their own PFTs (personal fires to tend). If you are hospitalized today with a serious health issue? Likely has it’s roots off in the past some place. But your personal fire illuminating future will matter by orders of magnitude greater than Trump, mullahs, or Minnesota.

Having said that (and prior to the really deep stuff) let’s pause and count noses and influencers that we can see. News is about watching for sparks. Let’s see the “canyon walls” of today.

China: China agrees to immediately lift sanctions on British MP.

Iran: Iran Rules Out Talks With U.S. Until Trump’s Threats Stop.

Europe: Iran to label EU armed forces as ‘terrorists’ over Guards blacklist (Are they really taking “war with everyone” meds?)

Ukraine: Ukraine sees quieter night after Trump says Putin will not attack its cities.

Minnesota: Former CNN journalist Don Lemon arrested in connection with Minnesota protest: Sources.

Rockslides to Notice (Trumpslides)

Trump nominates Kevin Warsh for Federal Reserve chair to succeed Jerome Powell

Trump threatens tariffs on countries selling oil to Cuba, declaring national emergency

Trump sues IRS and Treasury for $10 billion over leaked tax information

Data Dribbles

(Pee all over the place?) Well…producer prices, please gets us partway there…

The Producer Price Index for final demand increased 0.5 percent in December. Prices for final demand services advanced 0.7 percent, and the index for final demand goods was unchanged. On an unadjusted basis, prices for final demand rose 3.0 percent in 2025.

Will the markets be “Warshed” up? Naw…futures say dressed down…

Around the Ranch: Steering Note to Andy

Before understanding the helming of Life, a word (or several) about how math, future, and finance work down at the ontological level. (Where the Supreme(s) live – and influence substrate.

The Math of Adjacency

The Educational system does a shitty job of contexting. In my book Brain Amplifiers, one of the most useful contexts is that people fall into one of two categories. They either lock into singular domains or they are cross-domain oriented. Somehow, in how we educate ourselves, people take on what is (in computer terms) a “flat-file” database view of the future. Or, that take on a “relational-view.”

Flat-filers then to organize between the ears as “one-to-one” relationships. One fact = one dominant association. “One-to-many” people take in facts the same way, but between their ears massive generalization takes place. (I got onto the years ago in my book The Millennial’s Missing Manual. But the concept of correlating the “7 Major Systems of Life” is a kind of baseline.

Above all, though, it reveals that all humans are simple “test-fitting apes.” In other words, their way progress happens for most is that try sequential ideas (the Thomas Edison story, eh?) and after ‘n’ unsuccessful trials, a workable solution is found. Our government is (likely) doing this right now looking for a stable Element 115 (but that leaves the room and heads for fringe).

The Came Useful Insight

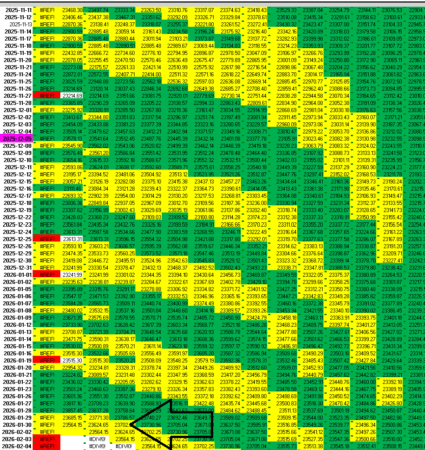

The visualization breakthrough for me on “How Future Happens” occurred when I was doing an adjacency study of successively longer moving averages of stock prices. Because, over time, you can see regularity peeking out of the green zones (successive advances) and declines (successive yellow) zones.

The visualization breakthrough for me on “How Future Happens” occurred when I was doing an adjacency study of successively longer moving averages of stock prices. Because, over time, you can see regularity peeking out of the green zones (successive advances) and declines (successive yellow) zones.

So, from the left-most column, you have today’s market (or index, or individual stock) and as you move to the right, the successive moving averages are calculated. So, the second column is the 2-day moving average, the 3rd column is the 3-day average, and so on.

The black arrow (bottom) is where we are slate to open this morning based on early futures prices. I should also tell you their line curvature is a processing artifact because by the extreme right side, I’m at a 42-day moving average, having settled (in the initial study) on moving averages of [ ^IXIC 2 day avg 3 day` 4 day 5 day 6 day 7 day 8 day 12 Day 16 Day 19 24 Day 30 Day% 42 day ] This section process creates curvature, not even timebase adjacencies. They create something different…

A Fingerprint of God

The realization that moving averages are a bidirectional indicator was somewhat shocking. Sure, running the number back (into the past) showed the “dying echo of events” and sure, useful, but not predictive.

Well, except for two things: The color bands (green is increasing, yellow decreasing) are useful for understanding the “market memory” of past pain. In sales and marketing, this is sometimes referenced (in parallel domain-thinking) as the Sandler Method. Created by David Sandler in 1967, this seven-step process is where “consultative sales” was born. But it intersects with stock market behavior because Step #3 in Sandler is “Making the Customer feel their pain.”

Which has it’s analogy in markets because losing money is a what? PAIN.

(See, you didn’t even need to get an MBA to follow, did you?”

So this kind of academic grounding (and tons of computer stuff) led to the Ebbinghaus-Ure Correlation which you can read about here. And yes, this color coding just fell out of that research (and using AI to turn me into a conditional formatting guru in Excel).

Now you have the baseline: While the successive moving averages reveal the echo, when you project to their LEFT of the chart above, you can then begin to predict TIME of market-driving events.

Now, I’m going to close this session of backwoods quant school, so we can move on to the durable part. And that’s a report from long-time reader Andy. Who, as long time readers will know has been on the verge of shipping out with the Merchant Marine for some months now. And suddenly his life has flipped – again.

What’s Going On with Andy

He explains in all:

“…another fork presented itself. something is working overtime to keep me stateside. just blew my mind. someone i helped over in wyoming called me out of the blue. made me an offer and i immediately replied, yes yes yes, of course i am most interested!

they said, when i asked myself who would be the best fit for this position, i sat down with pen and paper, drifted off for a moment in a day dream. then i looked down and i had written your name on it without realising it. and i thought that is odd. then i thought oh Andy is the best fit for this! so i prayed about it and decided to call you.

i havent talked to them in almost 2 years.

i laughed and how awesome! Yes! Yes! i am interested.

i have been delayed for almost a year going to MSC and now i’m beginning to understand why.

Divine Timing.

thanks again George,

I Win with God Within!”

Explaining the Unexplainable

May answer to him was long, but “owning the Big Pattern (of fingerprint) of the Future six the most profitable (not to mention spiritually-rewarding) thing a body can do.

“Yeah, Andy. When you really begin to see how [the Ontology, God, Great Spirit – or fill in your own name for it] works, you will come to appreciate – as you just noted- how our past behaviors “ripple forward” in time.

This is the perspective that is driving my research both in Peoplenomics “magic ovals” work, and it’s also – longer-term – when the new website time-engineering.com will go. Because mastery of the present doesn’t even begin to put you in line for one of the Dude’s understudy gigs. That alone is a great prerequisite, sure, but it’s not the whole thing.

I have been silently watching your own “probabilities drift” because as “potential futures” change, the very physical survival of people changes.

You see, MSC [merchant marine] would have put you on the Sea. Sea level. And yet, though imperfect, great seers and receivers (I won’t call them prophets – they are the finely-tuned human receivers of noise forming future] have warned a great deal lately about about how there will come a terrible global-impacting earthquake.

Now, in my (still evolving) beholding work, I just couldn’t see a path where the Dude (events forward) would be allowed Andy to be in harms way (sea level) pending great developments.

So the “weighting of future changed” at that point. And what happened – in the quintillion events people don’t notice every day – is that a critical future projection shifted. To where Andy will be “shown” the path to high ground.

While at the same time, there will be a re-weighting (heavier) in the direction of massive quake, tsunamis and such. (In other words, the odds go up of such an event.)

Now, if you will, imagine a “Million Andy’s” out there. They sense – but most often don’t “hear” the “forging of future” because they are full of (bullshit) noise that impairs cognition. However, the genius of Clif High’s work was that (coming at it from another direction) he discovered that the internet would provide “signal” in advance. G.A. Stewart’s work, too (over here) is another great tool for lining up future potentials. Different technologies both future-directed.

Even if you don’t specifically go to MSC, underlying change in the substrate is done – the future has been slightly re-cast.

Is it pareidolia (false pattern recognition) OR is there a triple letter score (missing math of the masses) in play? A few further thoughts in the Friday ATR section, but you may find it useful – one traveler/beholder to another. “

Obviously, I could go on – set you out links to places like Google Trends, the Global Consciousness Project, and so forth. But that’s the journey each of us has to weight time and effort into in harmony with the rest of our current life pathing.

So on that?

A special report for Peoplenomics is in the works 60-pages so far – on future implicates of an Iran conflict if it escalates to nuclear – is the most immediate “future worry.” But even though it should be weeks off (if at all_) reports of any Earthquake Tireds in the Comments section will be noted. Small things, likely not meaningful.

But the future is always an edge case and you gotta keep an eye on it.

Write when it’s time,

Read the full article here