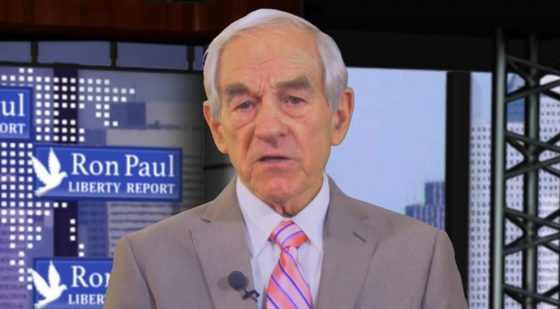

This article was originally published by Ron Paul at The Ron Paul Insitute for Peace and Prosperity.

Two days after Donald Trump became the first American since Grover Cleveland to win nonconsecutive presidential elections, the Federal Reserve announced a quarter percent cut in interest rates. Following this announcement, Fed Chairman Jerome Powell held a press conference where he said that he would not comply with any presidential request that he step down before his term ends in May of 2026.

Powell claimed that the president lacked the legal authority to fire the Fed chairman. So, if President Trump tells Chairman Powell “You’re fired,” Powell could bring suit asking a court to review Trump’s action.

President Trump and Chairman Powell are at odds over President Trump’s desire to require the Federal Reserve to consult with the president before changing interest rates or taking other significant actions. Powell is likely to do all he can to convince Congress to reject any legislation giving the president any type of official role in setting monetary policy. After all, Chairman Powell is so protective of Fed autonomy that he opposes auditing the Fed on the grounds that it could threaten the Fed’s independence, even though there is nothing in the Audit the Fed legislation giving the president or Congress any new authority over the Fed’s conduct of monetary policy.

Requiring the Fed to consult with the president regarding monetary policy would likely increase price inflation and dollar devaluation. Politicians usually like low interest rates because they associate low rates with economic growth. Politicians also want the Fed to keep rates low so the federal government can keep racking up huge amounts of debt. Without a central bank that is ready, willing, and able to monetize the federal debt, the welfare-warfare state would not exist.

Despite the claims of Chairman Powell and other central bank apologists, the Fed has never been free of political pressure. Presidents were trying to influence the Federal Reserve long before Donald Trump began posting “mean tweets” about Jerome Powell. Requiring the Fed to consult with the president would at least make the president’s efforts to influence monetary policy open and transparent.

President Trump and other Fed critics such as Massachusetts Senator Elizabeth Warren think they are more capable of determining the “correct” interest rate than the Fed. This ignores the fact that interest rates are the price of money and like all prices are shaped by a variety of constantly changing factors. When the Fed manipulates interest rates, it distorts the signals sent to investors. The result is the boom- bust business cycle. The fiat system is also responsible for rising income inequality and the decline of the dollar’s purchasing power, which has lowered most Americans’ standard of living.

President Trump should work to eliminate the need for the Fed to keep interest rates low. He can do this by fighting for massive spending cuts, starting with the military-industrial complex. He should also push Congress to pass the Audit the Fed bill. Additionally, President Trump should support legalizing all competing currencies. The forthcoming tax bill should include a provision exempting precious metals and cryptocurrencies from capital gains taxes. The key to making America great again is to make money free again.

Read the full article here